frequently asked questions

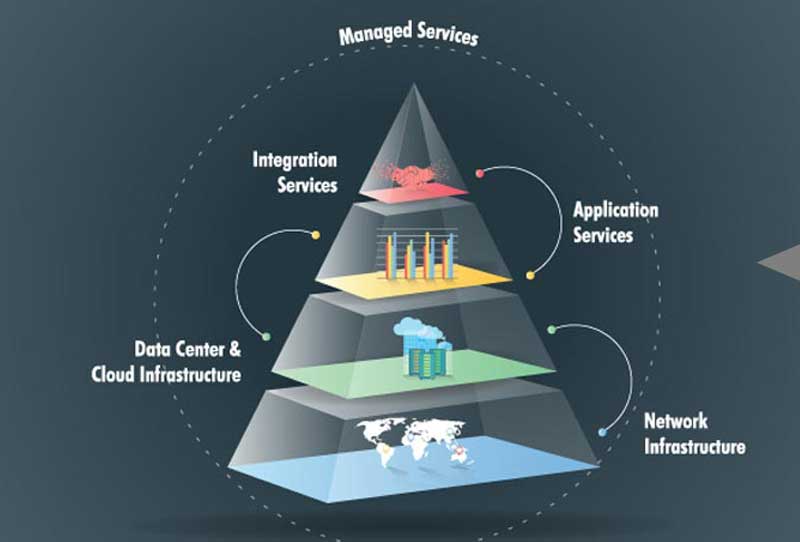

A single platform where Clients have access to inter-engaged ICT services.

When we started out as India’s first Private Internet Player, the promise to the market was that we would make the Internet accessible to all, a promise we very successfully delivered on. The Company’s guiding principle was to invest ahead of time and the technology curve; a linking of thinking that stood us in good stead when we choose to expand our services to the growing Enterprise segment which then demanded Data Centers, Applications and Cloud Services.

IT has been seen as the provisioning of software services from an application level. IT is only one component of ICT. ICT is an ecosystem that enables both IT and Telecom to access services specific to each other by enabling a convergence bridge.

We listed on the NASDAQ as the USA has a mature understanding of the potential of the internet. Our unique proposition was of being the first Indian ICT player to extend private Internet Service services. We continue to do so as we find a greater understanding of our services from the market in the USA which translates into credibility and leverage.

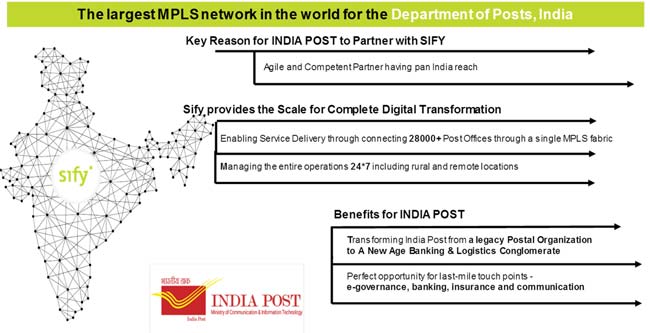

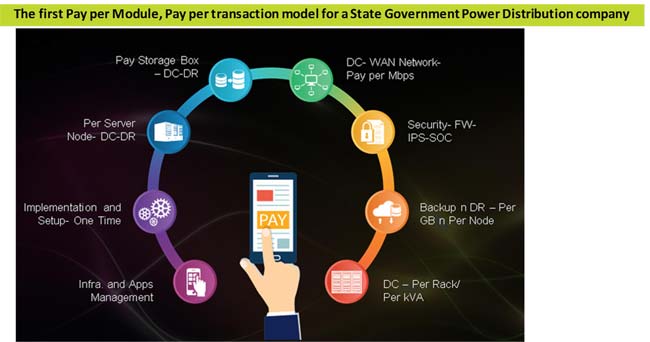

And yet, we successfully built out massive scale projects for the Department of Posts, Staff Selection Commission and Uttar Pradesh Power Corporation Limited. So size is not a prerogative. Quite to the contrary, it could be a constraint in a market like India. A mirror to the opportunity is that our revenue grew 21% CAGR over 4 years.

The argument of big vs small does not hold water in a market like India as the client is typically looking for a converged services provider.

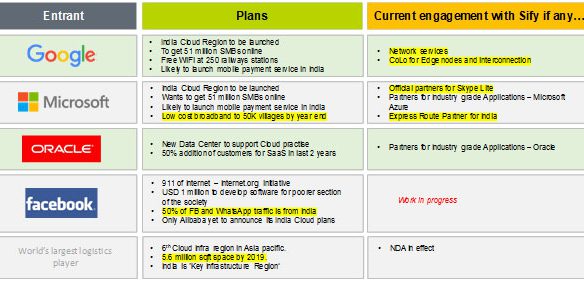

Currently, our target audiences are different. While we service clients across the spectrum, much of their entry when entering India is based on global alignments. In most cases, they are talking about coLocation or buying cloud space in existing DC except for the Private Cloud; this they want to invest into. The market is big enough to accommodate all of us. That’s on one side. Sify’s focus is on building private cloud and solutions for specific verticals. We began with the power and health vertical where we have tasted success

Big entrants see another business benefit. Players in the OTT, eCommerce, Applications space evaluate Sify from the coLocation and Network standpoint and then evaluate our offering SAP, Oracle, and Microsoft under our Industry Standard applications platform. This coupled with our entire ICT eco-system makes for a compelling reason to outsource IT services to Sify rather than invest in building it grounds up.

These past few years, we concentrated on establishing a firm foothold across both our business practices. Along the way, we delivered IT Transformational projects for marquee clients that has built our reputation as a digital transformation specialist. Going forward, we are building vertical strengths that will see us pursuing different industry verticals. For example, in BFSI, we are among the earliest private players to support the largest nationalized bank in India. That relationship continues and has expanded. They are a fitting case study for us to pull in other banks.

The DC and Cloud business is seeing interest from Data rich industries like health and hospitality that are actively pursuing cloud opportunities to support their Data growth and we would be pursuing that.

Offshore education companies tap us for our Talent management and iTest platforms. These will be also extended to closed group training programs. The alignment on industry standard applications with the leaders is to cast the net wider to all those MNC coming into India and giving them the quickest- off-the -block advantage.

We do have a strong strength of IP in our relevant fields as stated under the IPs for Business. A subscription allows us to disperse the IP advantage to a larger section of the enterprise community while simultaneously parring cost. The government’s latest push for Digitization and GST will only accelerate the demand for Data Centers, Network, and the Cloud services. With wider penetration, the exclusivity of licensed software will diminish and subscription-based services will be the order of the day.

The recent move to adopt the Real Estate Infrastructure Trust (REIT) will allow for us to lease real estate space through these trusts and not necessarily have to invest in them, making us asset light. As an asset-light company, this will open the doors to marketing our DC space differently by bringing in a different audience.

The first major milestone in Sify’s Enterprise play was when it transformed the Department of Post’s legacy systems into the largest Logistical player in India with a 30,000 strong MPLS network.

The second was also a government undertaking. The Staff Selection Commission of India, historically a paper and pencil examination got a complete recast as an online examination.

The third was perhaps the most unique project in that in a chaotic environment of power supply and billing in the state of Uttar Pradesh, Sify brought a semblance of order with India’s first pay-as-you-use billing cycle.

what are the non-financial metrics around the business?

telecom services

- Coverage – 1600 Cities and towns

- Number of customer circuits – 100,000+

- Managed endpoints – 35K +

- Number of PoPs – 2800 + (domestic) & 7 (international)

- Subscribed bandwidth – 360 Gbps

- Dark fiber (point to point) – 5300+ miles

- Inland fiber – 1600 Kms (leased fiber)

data center services

- Competitor DCs connected – 39

- Number of customers with 50+ racks -10

- Allotted power capacity – 45 MWA

- Cumulative Capacity – >200,000 sq.ft white space

cloud & managed services

- Number of Cores – 10K+

- Total storage – 5 Petabytes

application integration services

- 10 Million iTests, 101 cities, 407 centers

- Automated inventory & Supply Chain management on Cloud

what is your dividend payment track record?

We paid a dividend of 10% for 3 years and this year, we paid out 12% as. Dividend track record helps as a positive sign to investors.

how many employees do you have at the moment?

We have a total of 2138 employees. 26% of them carry between 10-15 years of overall experience and 20% have more than 15 years.

what is the average contract period that clients sign up for?

For Telecom, these could range from 1 to 3 years depending on the extent of coverage for Data Center & CMS, these could range from 3-5 years

AIS – FORUM clients usually sign up for a minimum of 3 and maximum of 5 years.

Maintenance periods for TIS projects are usually for 5 years

who are some of the big players coming into India and what is your engagement with them?