7 Challenges and Solutions for Fintech IT Leaders

- Scalability

Challenge: Rapid growth is a common characteristic of successful fintech organisations, and scaling IT infrastructure to meet increasing demands can be a daunting task.

Solution: Embrace cloud computing solutions to provide scalable resources on-demand, adopt a modular architecture that allows for easy expansion, and regularly assess and adjust capacity based on business needs.

Related Read: Unlocking Growth – Scaling Repeatable IT Processes and Environments

- High Availability and Reliability

Challenge: Downtime is not an option in the fintech world, where transactions happen in real-time.

Solution: Design a resilient architecture with redundant systems and failover mechanisms, conduct regular performance testing, and implement robust disaster recovery plans to ensure high availability and reliability.

- Cybersecurity Risks

Challenge: Fintech companies deal with sensitive financial data, making them prime targets for cyber threats.

Solution: Implement a multi-layered cybersecurity approach with encryption, firewalls, and intrusion detection systems. Conduct regular penetration testing, educate employees on cybersecurity best practices, and stay abreast of evolving threats to proactively defend against potential breaches.

- Legacy System Integration

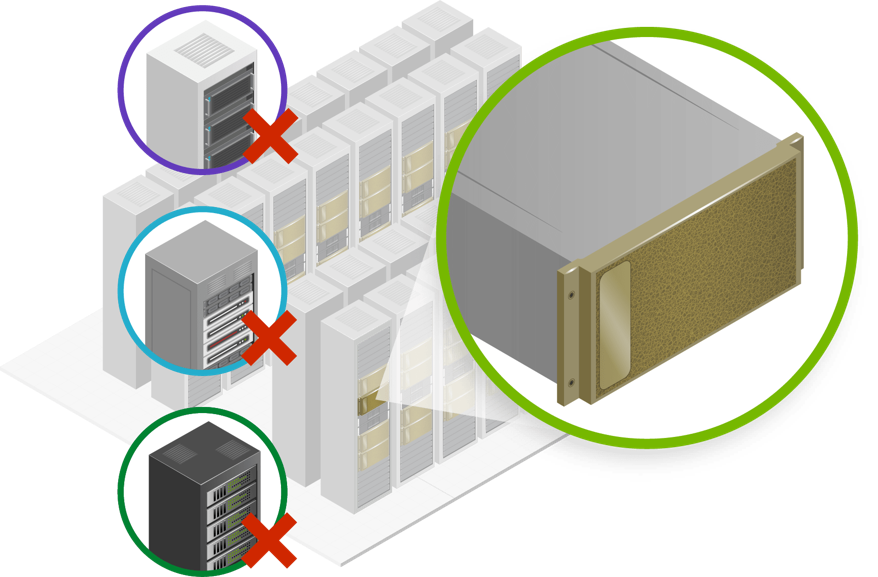

Challenge: Many fintechs inherit legacy systems or work with partners using older technologies, creating compatibility issues.

Solution: Prioritise interoperability when adopting new technologies, invest in middleware solutions to bridge the gap between legacy and new systems, and consider a phased approach to integration to minimise disruptions.

Related Read: Utilise Sify for the skills and expertise to assist your cloud strategy

- Compliance and Regulatory Demands

Challenge: Fintech companies operate in a heavily regulated environment with evolving compliance requirements.

Solution: Leverage automation to streamline compliance processes and reduce the possibility human errors.

- Data Management Complexity

Challenge: Fintechs deal with vast amounts of data, and managing, processing, and extracting meaningful insights from this data can be complex.

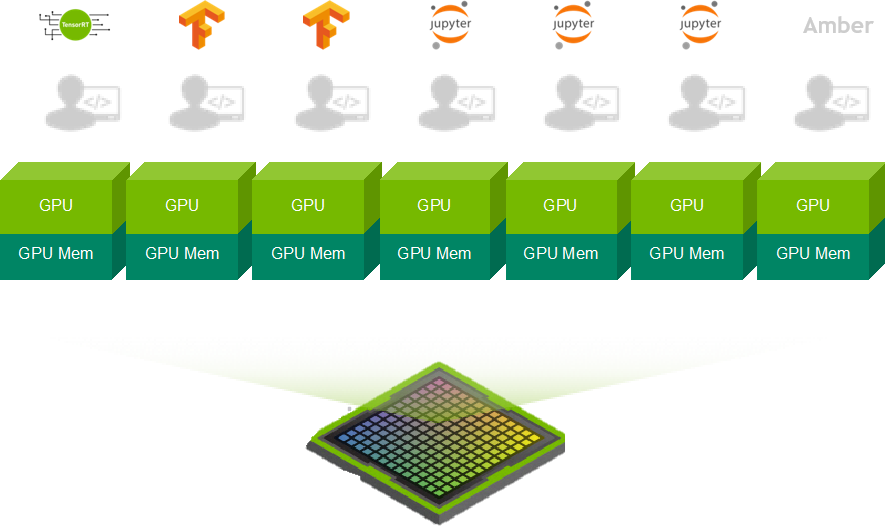

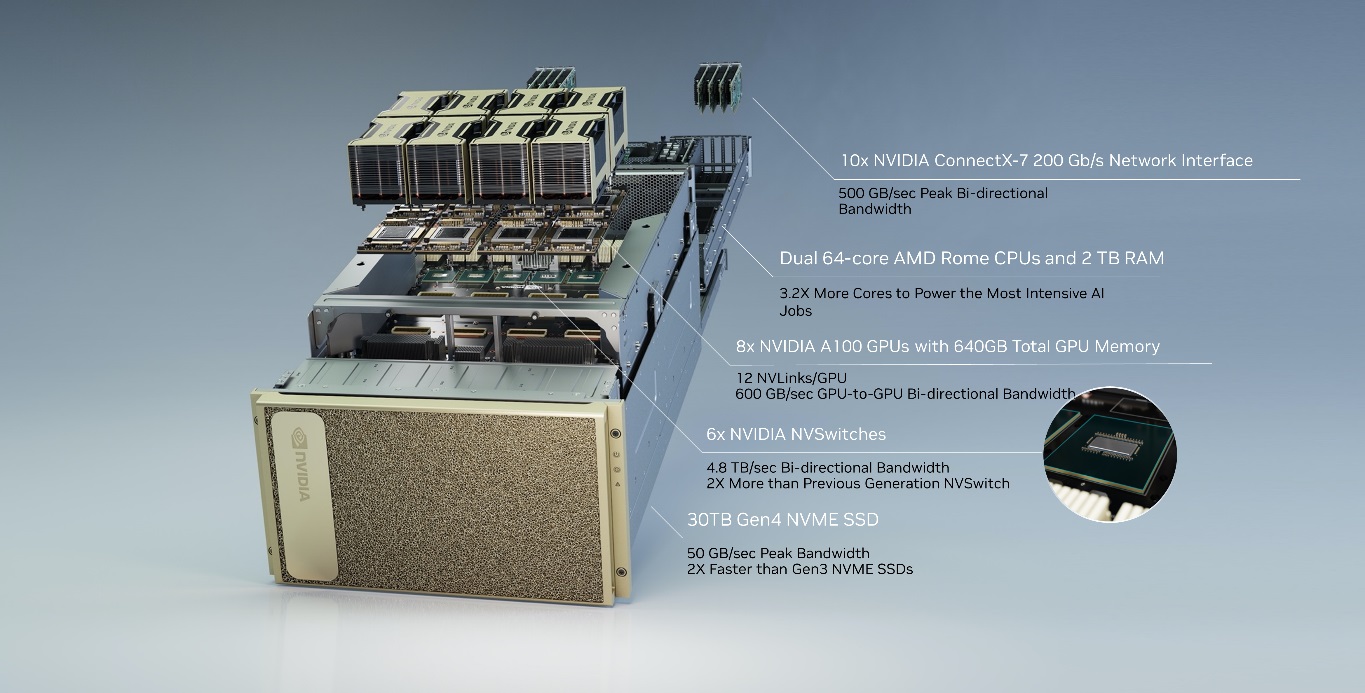

Solution: Implement advanced data management and analytics tools, leverage machine learning for data analysis, and establish robust data governance frameworks to ensure data accuracy, security, and compliance.

- Talent Acquisition and Retention

Challenge:Attracting and retaining skilled IT professionals in a competitive market can be challenging.

Solution: Provide opportunities for professional development, foster a positive and collaborative workplace culture, leverage IT partners to plug any resources gap you have and actively engage in partnerships with learning organisations to develop business talent.

Related Read: Empower Your Workforce with Digital Learning and Deliver Results

Conclusion

Addressing the challenges of IT infrastructure management is integral to sustained success. By focusing on finding solutions to the key challenges, fintech organisations can build a resilient and agile IT infrastructure that not only meets current demands but positions them for future growth and innovation.How Sify Can Help

Sify is ideally placed to help businesses build a sustainable, fully optimised IT infrastructure that meets long-term business needs. We offer deep expertise in all areas of cloud and IT infrastructure, combined with proven methodologies and frameworks to help analyse, design and optimise cloud environments. Our proven experience and expertise have delivered for organisations seeking to optimise their cloud infrastructures, including reducing costs and ensuring resources are right sized, accelerating deployment time for new applications, improving alignment between business functions and helping firms integrate new cloud-based technologies such as AI or analytics.The Key Challenges We Solve

With a heritage in IT Infrastructure, Sify has grown over two decades to provide a one-stop engagement across networks, data centre, cloud, digital and IT services. Sify enables you to build an IT infrastructure that underpins business profitability, by delivering flexible expertise to fill IT skills gaps, and by deploying, managing and optimising complex hybrid environments to deliver the right combination of flexibility, security and affordability. Here are the key challenges our Managed Services can help your organisation solve:

Optimisation Future-proof your business by optimising your use of cloud technology

Resources Increase responsiveness with access to the right scale and calibre of specialist IT skills as and when you need them

Cost Savings Make your IT budget go further by lowering your costs and becoming more efficient

Reduce Risk Control your risks by ensuring the security and resilience of your IT infrastructure

Navigating the Future: The Rise of Mesh Networking in Fintech

Redundancy: A Shield Against Disruptions

Fintech operations are the lifeblood of financial transactions, and any disruption can have far-reaching consequences. Mesh networking offers a robust solution to this challenge by creating a web of interconnected nodes. In the event of a network failure or disturbance, data can seamlessly reroute through alternative pathways, ensuring uninterrupted service. This redundancy feature is like having multiple safety nets in place, fortifying the fintech ecosystem against potential downtimes or data breaches.Speed: Accelerating Financial Transactions

In fintech, split-second decisions and rapid transactions are the norm, so speed is non-negotiable. Mesh networking optimises network speed by enabling data to take the most efficient route between nodes. This not only enhances the overall performance of financial systems but also ensures that transactions are executed with unprecedented efficiency. As fintech companies grapple with the demand for quicker processing times and real-time analytics, mesh networking emerges as a strategic option, driving them to accelerated operations.Related Read: Transform your IT Infrastructure with Sify’s Cloud Advisory Services to fast-track your digital plans

Data Security: Safeguarding the Financial Realm

Given the regulatory changes within fintech, securing data has never been more critical and mesh networking can potentially help as a proactive measure. By decentralising the network architecture, mesh networks reduce the vulnerability of a single point of failure, making it inherently more secure. In an industry where trust is vital for success, mesh networking provides an extra layer of protection against cyber threats, ensuring that financial data remains confidential and transactions are shielded from potential breaches. Incorporating mesh networking designs should always be considered as best practice in building any resilient and robust service environment. This will always help mitigate the risk of data loss or corruption whilst in transit.Adapting to Dynamic Environments

Fintech landscapes are constantly evolving, and the adaptability of mesh networking aligns seamlessly with the sector’s need for flexibility. Whether scaling operations, integrating new technologies, or navigating the intricacies of a distributed workforce, mesh networking accommodates these changes with ease. Its modular and scalable design empowers fintech companies to evolve without compromising on the reliability and speed of their network infrastructure.Discover flexible IT expertise with Sify’s Managed Services

Conclusion

The growing interest in mesh networking within the fintech sector is a testament to its ability to address the industry’s pressing needs for complete redundancy and optimised speed in network infrastructure. As fintech companies strive for innovation, efficiency, and resilience, mesh networking emerges as a strategic enabler, driving them toward a future where connectivity is seamless, operations are swift, and data security is paramount.The Key Challenges We Solve

Sify is an IT and Digital Services company that specialises in IT infrastructure and consultancy to deploy, manage and optimise complex hybrid environments including Google Cloud and AWS. With a heritage in IT infrastructure, Sify has grown over two decades to provide a one-stop engagement across networks, data centre, cloud, digital and IT services. Sify enables you to build an IT infrastructure that underpins business profitability, by delivering flexible expertise to deliver the right combination of flexibility, security and affordability. Here are the key challenges our Managed Services can help your organisation solve:

Optimisation Future-proof your business by optimising your use of cloud technology

Resources Increase responsiveness with access to the right scale and calibre of specialist IT skills as and when you need them

Cost Savings Make your IT budget go further by lowering your costs and becoming more efficient

Reduce Risk Control your risks by ensuring the security and resilience of your IT infrastructure